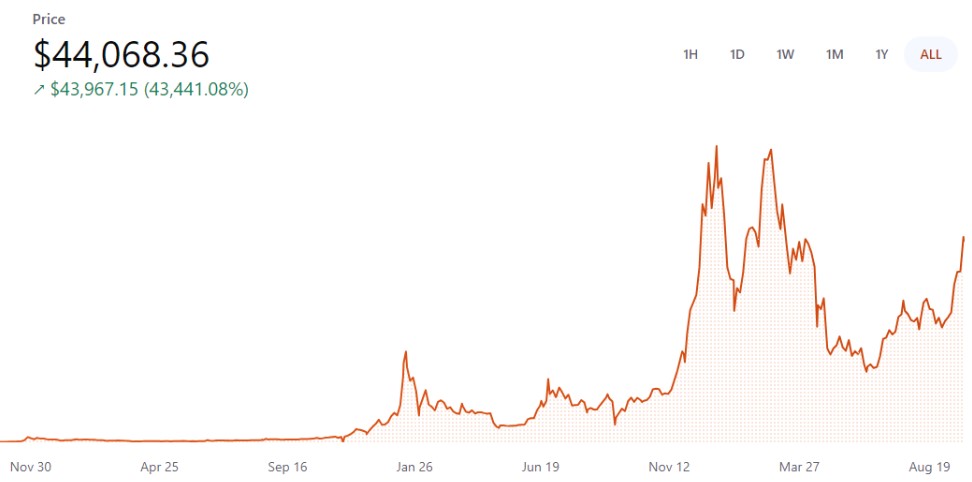

Bitcoin surpasses $44,000 mark

BITCOIN (BTC) BULLISH TREND KRYPTOWALUTA FOMO HALVING07-Dec-2023

TOP posty

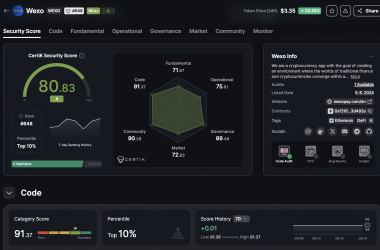

Prestigious auditor ranked WEXO among TOP10% of projects

The listing on a centralized exchange, together with the excellent audit result and the 8th place among payment pro...

Czytaj więcej

Wexo Points: Find places where you can pay with Bitcoin (App Up...

Search nearby businesses that accept Bitcoin payments

Czytaj więcej

Wexo Meetup Košice on 27 April (invitation)

Saturday full of news and innovations this time in the metropolis of the east!

Czytaj więcejBitcoin has recently experienced a significant increase. For the first time this year, it has surpassed the $44,000 mark, supported by prospects of decreasing interest rates in the USA and expectations associated with the approval of Bitcoin ETFs. With a value of $44,068.36, Bitcoin is approximately 36% below its historical maximum of $68,789.63, indicating it still has ample room to grow.

While all eyes are on Bitcoin, we should not forget its younger sibling Ethereum, which recently reached its 18-month high with a current price of around $2,200.

Reasons Why the Price of Bitcoin Could Increase:

One of the most important upcoming events next year is the anticipated Bitcoin Halving in April 2024. This process will again reduce the reward for mining new blocks by half and has historically always positively influenced BTC's price. Due to the reduced influx of new coins into the market and unchanged energy costs for mining this cryptocurrency, previous halvings have always been reflected in a significant price increase.

We also can't forget about the Bitcoin ETF and its expected approval, which could take place between January 5th and 10th, 2024. BlackRock, the world's largest asset manager, was among the first to apply for a Bitcoin ETF in June this year. Subsequently, other major players like Fidelity, Invesco Galaxy, WisdomTree, and others applied for spot Bitcoin ETFs. Approval would open doors to institutional investors, thus allowing a massive influx of capital into Bitcoin.

Another key factor is the current availability of Bitcoin on exchanges, where only about 5% of the total circulation is found. In recent weeks, we have witnessed an increased transfer of Bitcoin from exchanges to private wallets. This indicates that investors and miners are interested in holding Bitcoin for the long term, thereby reducing the quantity available for public purchase directly from exchanges.

Considering the upcoming presidential elections in the USA, history shows that no political party ever starts its rule with a declining economy. Therefore, it's likely that the new electoral term will be accompanied by the printing of new money to support the country's development. Historically, whenever the economy grew, so did the price of Bitcoin.

In South America, we have witnessed interesting political developments related to Bitcoin. Argentine President Javier Milei, known for his support of this cryptocurrency, is now in a position where he can significantly influence its adoption and perception not only in Argentina but also in the wider region. On the other hand, Colombian President Gustavo Petro, who recently joined the group of Bitcoin holders, is paving the way for further discussions on integrating digital currencies into his economy.

A significant step that could further elevate Bitcoin in the traditional financial sector is the recent decision allowing banks to hold up to 2% of their reserves in cryptocurrencies from 2025. This step, approved by the Bank for International Settlements (BIS), could potentially double the current $1.54 trillion market capitalization of cryptocurrencies. There is also discussion about the possibility of banks holding up to 5% of their reserves in cryptocurrencies in the future.

Finally, recent steps towards cryptocurrency regulation in the European Union (MiCA) indicate an effort to create a more stable environment for cryptocurrencies. These regulations could increase investor confidence and thereby support further growth in Bitcoin.

Conclusion

Considering these factors, including the historical development of Bitcoin's price post-halving, reduced supply on exchanges, and support from political leaders in South America, Bitcoin may represent an attractive commodity. For those looking to enter the world of cryptocurrencies, the Wexo app offers a quick and easy way to purchase Bitcoin. Download the Wexo app and discover the simplicity and convenience of buying Bitcoin.