President Čaputová and the New Era of Cryptocurrencies in Slovakia

CRYPTOCURRENCY18-Jul-2023

Publicaciones principales

Wexo Points: Find places where you can pay with Bitcoin (App Up...

Search nearby businesses that accept Bitcoin payments

Leer másThe President of the Slovak Republic, Zuzana Čaputová, recently signed a modification to the income tax law, which will significantly affect cryptocurrency owners in Slovakia. This new law, proposed by SaS MPs, aims to reduce the tax and fee burden associated with the sale of virtual currencies.

The key innovation is the introduction of a "time test". If you sell a cryptocurrency that you've held for more than a year, your earnings will be taxed at a lower rate of 7%. Conversely, when selling cryptocurrencies within a year, the income is included in the tax base and other incomes.

The aim of this proposal is to significantly ease investing and saving for ordinary citizens. The current taxation of income from securities is in stark contrast to the goal of promoting voluntary forms of retirement savings.

This amendment also brings changes to the taxation of income from mining or staking of cryptocurrencies. Such income will only be included in the tax base when sold. Exchanging one cryptocurrency for another, except for stablecoins, will no longer be taxed.

Another interesting point is that income from the sale of cryptocurrency exchanged for property or services up to €2,400 per year will not be taxed. This could have a significant impact on the wider acceptance and use of cryptocurrencies in everyday life.

The amendment also frees individuals from the obligation to pay health insurance contributions from income from the sale of cryptocurrencies, provided the cryptocurrency is not part of their business assets.

Thanks to the amendment of the Securities Act, the maximum amount of funds that can be invested within long-term investment savings for one calendar year will be doubled - the amount increases from the original €3,000 to €6,000.

Simultaneously, the amendment to the Collective Investment Act expands the circle of investors who can invest in alternative investment funds and increases the proportion of assets that such funds can have from qualified investors, from the original 20 to 30 percent.

MPs also approved a change concerning so-called charitable advertising, which increases the upper limit of income from this advertising from €20,000 to €30,000.

These changes show that Slovakia is ready for a new era of digital economy and cryptocurrencies. It remains important to monitor how these changes will manifest in practice and how they will affect the overall atmosphere around cryptocurrencies in our country.

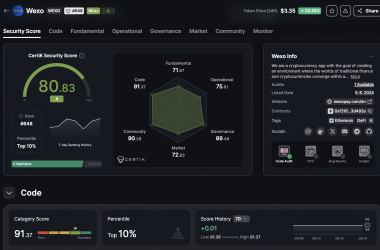

If you do not yet own any cryptocurrencies, don't hesitate to change it. Download our Wexo app, where you can quickly and easily purchase all popular cryptocurrencies. You can download the app directly from the App Store or Google Play. Join the digital revolution and discover how cryptocurrencies can enrich your investment portfolio.