The great Bitcoin accumulation has begun, says Gemini's Winklevoss

BITCOIN (BTC) BLOCKCHAIN MARKET CAP28-Jun-2023

TOP posty

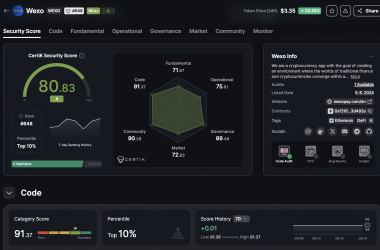

Prestigious auditor ranked WEXO among TOP10% of projects

The listing on a centralized exchange, together with the excellent audit result and the 8th place among payment pro...

Czytaj więcej

Wexo Points: Find places where you can pay with Bitcoin (App Up...

Search nearby businesses that accept Bitcoin payments

Czytaj więcej

Wexo Meetup Košice on 27 April (invitation)

Saturday full of news and innovations this time in the metropolis of the east!

Czytaj więcejThe recent surge in optimism for the approval of an exchange-traded commodity (ETF) for Bitcoin has sparked a "Great Bitcoin Accumulation Race." The reason for this phenomenon is the increased activity of large institutions such as Fidelity, Invesco, Wisdom Tree and Valkyrie, which have filed Bitcoin spot ETF applications with the U.S. Securities and Exchange Commission.

Cameron Winklevoss, co-founder of cryptocurrency exchange Gemini, said on June 21 that in his opinion, the "Great Accumulation" of Bitcoin has begun among institutions and retail investors. He pointed out that buying Bitcoin before ETFs hit the public market is akin to buying stocks before they are officially listed on the market in an initial public offering. According to Winklevoss, the "window" for buying Bitcoin is "closing fast."

MicroStrategy Executive Chairman Michael Saylor added his perspective on the situation in a post in which he suggested that retail investors could soon be crowded out by growing institutional demand: "The window for Bitcoin accumulation in front of institutions is closing." These statements point to an ongoing shift in the cryptocurrency market and suggest an escalation in the near future.

A "Bullish" sign for crypto. After Blackrock, more institutional managers are filling for spot Bitcoin ETFs

Nasha Afshar, CEO of SEBA Bank, said the growing institutional interest in cryptocurrencies is a significant positive signal for the entire sector. According to Afshar, looking at the evolution of investments in Web3 projects is changing the discussion about cryptocurrency investments. Nowadays, instead of the question of "if" to invest, the question of "when" is already being asked.

Afshar pointed out that although there was significant interest in cryptocurrencies during the bull market, the number of real investments was lower than nowadays. Today, she said, we are seeing more activity and real moves towards investing in the sector.

Afshar cites Citadel's backing of a cryptocurrency exchange, BlackRock's request for a spot Bitcoin ETF, and similar moves by WisdomTree and Invesco as examples. These moves, she says, represent "a significant optimistic signal for the entire industry." She stressed that the question among institutional investors is no longer "if" but "when" to invest in cryptocurrencies. Afshar believes that we are witnessing not only a change in mindset but also in action, which is indicative of the expected expansion of this sector.

After 2 years, Bitcoin reaches 50% market dominance and its price surpassed $31,000

Bitcoin has regained its 50 percent market dominance after two years, reflecting its increased influence on the overall cryptocurrency market. It reached this key milestone on June 19 with a price of over $31,431. Ether, on the other hand, has maintained its position with market dominance at around 20% for more than a year. Together, these two leading cryptocurrencies account for approximately 70% of the total cryptocurrency market.

Michael Saylor, co-founder of MicroStrategy and a strong proponent of Bitcoin, predicts that Bitcoin's market dominance will increase to 80% in the coming years. This argument is part of a trend where investors are looking for a safe haven in times of uncertainty associated with increasing regulatory intervention. Bitcoin currently boasts half the value of the total cryptocurrency market capitalization, which stands at $1.19 trillion.

In the last week, we have seen a significant increase in Bitcoin's dominance. Bitcoin's current price as of June 27, 2023 is $30,650, an increase of more than 98% compared to the $15,476 Bitcoin reached on November 6, 2022. Thus, despite some market tensions, Bitcoin's value has almost doubled in the last eight months, reaffirming its leadership position in the cryptocurrency market.