The end of the "wild west". The cryptocurrency market in the EU will receive supervision and rules

KRYPTOWALUTA NFT SCAM STABLE COIN18-Oct-2022

TOP posty

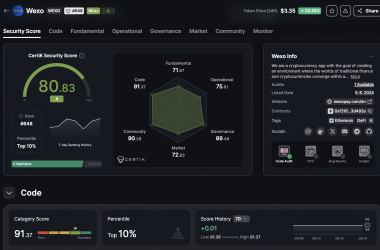

Prestigious auditor ranked WEXO among TOP10% of projects

The listing on a centralized exchange, together with the excellent audit result and the 8th place among payment pro...

Czytaj więcej

Wexo Points: Find places where you can pay with Bitcoin (App Up...

Search nearby businesses that accept Bitcoin payments

Czytaj więcej

Wexo Meetup Košice on 27 April (invitation)

Saturday full of news and innovations this time in the metropolis of the east!

Czytaj więcejThe European regulation for MiCA cryptocurrencies has moved closer to final approval. The Markets in Crypto Assets regulatory framework regulates the rules for cryptocurrencies, their issuers, and cryptocurrency service providers. The proposal is now on the table of the Committee for Economic and Monetary Affairs of the European Parliament.

The goal of MiCA is to create uniform rules for cryptocurrencies among all EU member states.. According to representatives of the European Council, the lack of an overall EU framework for cryptocurrencies can lead to a lack of user confidence in these assets, which could significantly hinder the development of the market for these assets. The European Council said in a statement that it is important to ensure that EU financial services legislation is fit for the digital age and contributes to a future-ready economy that works for people, including by enabling the use of innovative technologies.

MiCA is meant to protect consumers. Consumers' wallets will now have to adhere to strict requirements to protect consumers' wallets and be liable if they lose investors' cryptoassets. At the same time, they will have to say what their impact is on the environment and climate.

In the eyes of the cryptocurrency community, MiCA is often associated with violating user privacy at some points. However, it is the first time that the EU has included crypto-assets in its regulatory framework, trying to bring more clarity to the market as some member states already have their own regulations. Until now, there was no EU-wide regulatory framework.

"Recent developments in this fast-growing industry have confirmed the urgent need to regulate it at EU level. The MiCA Regulation will bring better protection to Europeans who have invested in these assets and prevent the abuse of crypto-assets while ensuring an environment that supports innovation in order to maintain the attractiveness of the EU," said Bruno Le Maire, French Minister of Economy, Finance and Industrial and Digital Sovereignty.

The strict framework also applies to stablecoins, i.e. cryptocurrencies of stable value. Consumers will be protected by the Crypto Assets Regulation, which will require stablecoin issuers to set up a reserve with a one-to-one ratio and part of it in the form of deposits.

Providers of services linked to cryptoassets will also be required to obtain a permit in order to operate within the EU. Non-fungible tokens (NFT), i.e., digital assets representing real objects such as art, music, and videos, will be excluded from the scope, except where they fall under existing crypto-asset categories.

The head of the largest crypto exchange, Binance, Changpeng Zhao, called the regulation of MiCa "excellent" and said that it will become "a global regulatory standard that will be copied around the world."

This groundbreaking regulation will end the period without any regulation that has existed in the field of crypto-assets until now. The market will be clear of fraudulent projects (so-called scams) and only the best companies that meet the necessary standards will compete for users.