FC Barcelona has raised 120 million euros for its Web3 initiative, Barça Vision

BITCOIN (BTC) ETHEREUM (ETH) LIGHTNING NETWORK WEB 3.018-Aug-2023

TOP posty

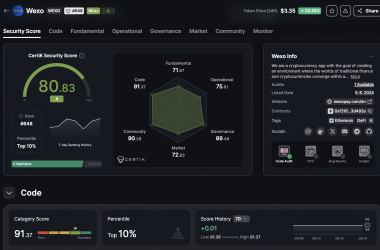

Prestigious auditor ranked WEXO among TOP10% of projects

The listing on a centralized exchange, together with the excellent audit result and the 8th place among payment pro...

Czytaj więcej

Wexo Points: Find places where you can pay with Bitcoin (App Up...

Search nearby businesses that accept Bitcoin payments

Czytaj więcej

Wexo Meetup Košice on 27 April (invitation)

Saturday full of news and innovations this time in the metropolis of the east!

Czytaj więcejSpanish football club FC Barcelona has secured an investment of €120 million from Libero Football Finance AG and Nipa Capital B.V. for its Web3 initiative, called Barça Vision. According to an announcement on 11 August, FC Barcelona sold a 29.5% stake in Bridgeburg Invest, the holding company of Barça Vision, in exchange for this capital. The Barça Vision project represents the club's efforts to integrate all digital content around Web3 and blockchain, including NFTs and the metaverse, as part of a strategy to create a digital Espai Barça.

Libero is a publicly traded company in Germany that advises football clubs on financial matters, while Nipa Capital is an equity fund based in the Netherlands. The transaction is still subject to approval by FC Barcelona shareholders and is expected to close in Q4 2023.

Since February 2020, FC Barcelona has been working with blockchain Chiliz to create FC Barcelona Fan (BAR) tokens based on the Ethereum platform. In May, the club launched its first NFT collection with Plastiks under the name "Unleash Your Passion". This collection includes 3,000 animal-themed NFTs priced at $30 each, the proceeds of which will go towards "removing 35,000,000 kilograms of plastic from our planet."

Bitcoin Lightning is becoming an important part of the Philippines and other emerging countries

The Philippines, one of the world's top recipients of foreign remittances, is experiencing significant changes in digital transactions thanks to Bitcoin's Lightning network. In 2022, foreign remittances reached a record $36.14 billion, highlighting the integral role of overseas Filipino workers in the national economy. Integrating the Lightning Network into the country's financial system could make it much easier for these workers to send money home, avoiding the high fees and inefficiencies of traditional financial systems.

Currently, the Philippines is experiencing rapid growth in its digital economy. It is expected to reach a value of $35 billion by 2025 and between $100 and $150 billion by 2030. The Lightning network has already begun to contribute to the growth of many small businesses in the Philippines that now accept and process payments in bitcoins. This opens the door for them to foreign tourists, which can have a positive impact on the local economy.

Despite the promising prospects for cryptocurrencies in the Philippines, there are still challenges ahead for the Lightning Network. These include technical hurdles, regulatory challenges, and the need for wider education and adoption of the technology. If these challenges are properly addressed, Bitcoin and the Lightning Network can make a significant contribution to the economic modernization of the Philippines and set a model for other developing countries.

52 years have passed since the abolition of the gold standard

52 years ago, President Richard Nixon ended the option to convert the US dollar into gold, signalling the end of the Bretton Woods Agreement era. Experts point out that since the world abandoned the gold standard, global growth has surged, built on credit and free-floating fiat currencies. In 1972, global GDP was $3.8 trillion. Today's International Monetary Fund estimates put global GDP at $105 trillion, $5 trillion higher than in 2022.

Since then, the economy has experienced unprecedented growth, but also related concerns about the sustainability of fiat currencies. In recent years, the BRICS group of countries (Brazil, Russia, India, China and South Africa) has been strongly calling for a reassessment of the US dollar's status as the world's reserve currency. This pressure, coupled with an increase in global financial instability, is increasing interest in alternative forms of value.

One such alternative that is gaining more and more popularity is Bitcoin. Not only is it considered "digital gold", but in many aspects it surpasses traditional currencies in its decentralisation, transparency and independence from states or central banks. Another interesting trend is the growing support for Bitcoin by several candidates for the US presidency. Many of them have already publicly expressed their support for the cryptocurrency and are even accepting contributions to fund their campaigns in BTC. Recent findings have shown that even one of Donald Trump's Ethereum wallets holds more than $2.8 million.