DeFi: What are the advantages and disadvantages of decentralized financing?

Aplikacje zdecentralizowane (dApps) DeFi11-Jan-2022

TOP posty

Wexo Meetup Košice on 19 October (invitation)

Saturday full of news and innovations this time in the metropolis of the east!

Czytaj więcej

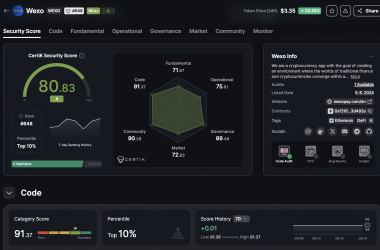

Prestigious auditor ranked WEXO among TOP10% of projects

The listing on a centralized exchange, together with the excellent audit result and the 8th place among payment pro...

Czytaj więcej

Wexo Points: Find places where you can pay with Bitcoin (App Up...

Search nearby businesses that accept Bitcoin payments

Czytaj więcejWe use "decentralized financing" to refer to the financial services on public blockchains (especially Ethereum). It is well-known as DeFi and has many advantages but also several disadvantages.

With DeFi, you can do most of the things banks support - earning interest, borrowing, lending to others, buying insurance, trading in derivatives, or trading in assets. However, with DeFi you will do it faster, without unnecessary paperwork or third party input. As with cryptocurrencies in general, DeFi:

- is global,

- takes place peer-to-peer (directly between two people, not routed through a centralized system),

- is anonymous and open to all.

Why is DeFi important?

Decentralized financing (DeFi) solutions have proven on several occasions to be a better alternative to traditional funding, which stems from the need for an open, secure and transparent financial system. With DeFi, users can take advantage of lower transaction rates, higher interest rates or the opportunity to diversify investments.

DeFi takes over the basic premise of bitcoin - the existence and trading of digital money - and expands it, thus creating a digital alternative to traditional exchanges (e.g., Wall Street), but without all the associated costs (office space, staff salaries, etc.). So more open, freer, and fairer financial markets, accessible to anyone with an Internet connection, create.

DeFi vs traditional financing

The DeFi applications common goal is to restore traditional financial systems (banks or stock exchanges) by using cryptocurrency. The main difference is that DeFi applications run without a central service to exercise control over the entire system.

Through DeFi, users can lend a cryptocurrency, as a traditional fiat bank does, and earn interest as a lender. Borrowing and lending are among the most common cases of using DeFi applications. Still, there are also many increasingly complex options - for example, you can become a liquidity provider for a decentralized exchange.

The interest rates are usually more attractive than in traditional banks, and the barrier to entering on a loan is low compared to the conventional system. The only requirement for obtaining a DeFi loan is, in most cases, the ability to provide collateral with other cryptographic assets - you can offer your NFT or non-replaceable tokens, all depending on the DeFi protocol used. Similar factors contribute to why DeFi is riskier than a traditional bank.

Advantages of DeFi

The main advantages of decentralized financing include:

- Easy access - you don't have to ask for anything or "open" an account. You can only access it by creating a crypto wallet.

- Anonymity – you do not have to provide your name, email address, or personal information.

- Flexibility – you can move your assets anywhere at any time without having to apply for a permit, wait for long transfers to complete, and pay expensive fees.

- Speed – interest rates and rewards update quickly (usually every 15 seconds) and can be significantly higher than traditional Wall Street.

- Transparent – All participants can see the whole set of transactions (private companies and banks rarely provide this kind of transparency).

Disadvantages of DeFi

Fluctuating transaction rates or asset risk – active trading can be expensive. Because cryptocurrencies are volatile, their value often fluctuates. If there is a decline, the value of the crypto assets used as collateral may fall sharply, and some may see the liquidation of their positions. Therefore, some use stablecoins, which are thought to be bound to fiat and are less volatile.

High volatility or risk of technology – smart contracts or code collections that execute a set of instructions on a blockchain are essential for DeFi applications to work. However, if a code problem occurs, there may be potential shortcomings in the DeFi protocol. Depending on which dapps you use and how you use them, your investment may be highly volatile - in the end, it is a relatively new technology, and at the end of the day, the software is only as good as the coding that has been done.

Product risk – less mature funds or newer protocols are not tested and usually have higher returns. There is a considerable amount of risk associated with how your revenue is generated. Unlike a traditional bank, there is no regulation or insurance of your money with DeFi. Other cryptographic assets secure deFi loans; borrowers using DeFi protocols cannot be held liable if they cannot repay the loan effectively. Invest as much as you can afford to lose and do thorough research before entering DeFi.

Current use of DeFi

Decentralized finance is still in the early stages of its development. The total value of the DeFi contracts 2021 was around $ 101 billion to 28/12/2021.

We can calculate the total locked value by multiplying the number of tokens in the protocol by their weight in US dollars. Although the overall figure for DeFi is breath-taking, it is essential to note that this is an imaginary number. Many DeFi tokens lack sufficient liquidity and volume to trade in crypt markets.

Users usually connect to DeFi through software called "dapps" (decentralized applications), which currently run on blockchain Ethereum. Unlike a regular bank, there is no need to fill out an application or open an account. There are now several ways people to experience DeFi:

- Lending – if you lend your cryptocurrencies, you can earn interest and rewards every minute, not just once a month.

- Getting a loan – you can get a loan immediately without filling out paperwork, including extremely short-term "flash loans" that traditional financial institutions do not offer.

- Trading – you can conduct peer-to-peer trading with certain crypto assets. It works similarly to buying and selling stocks without using brokerage services.

- Savings for the future – you can deposit some of your cryptocurrencies on savings account alternatives and get better interest rates than you would typically get from your bank.

- Purchase of derivatives – you can place long or short bets on certain assets. Think of it as a crypto version of stock or futures options.