World's largest asset manager BlackRock calls for first Bitcoin ETF

ASSET BITCOIN (BTC) CRYPTOCURRENCY DIGITAL ASSET21-Jun-2023

TOP-Beiträge

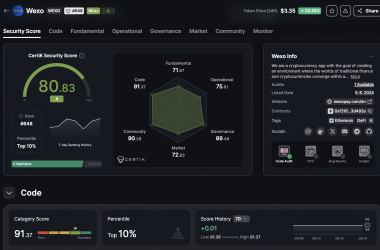

Prestigious auditor ranked WEXO among TOP10% of projects

The listing on a centralized exchange, together with the excellent audit result and the 8th place among payment pro...

Mehr lesen

Wexo Points: Find places where you can pay with Bitcoin (App Up...

Search nearby businesses that accept Bitcoin payments

Mehr lesen

Wexo Meetup Košice on 27 April (invitation)

Saturday full of news and innovations this time in the metropolis of the east!

Mehr lesenBlackRock, which is considered to be the largest asset manager in the world, recently filed for a Bitcoin ETF (Exchange Traded Fund) in the US. This application may have a profound impact on the future of cryptocurrencies and their acceptance among assets managing funds. An ETF is a type of investment fund that tracks the value of a particular asset or commodity, in our case Bitcoin.

BlackRock filed its application on June 15. It stipulated that Coinbase Custody Trust Company would be the custodian of Bitcoins in the fund, while Bank of New York Mellon would be in charge of the fiat currency. The move was designed to remove the hurdles and operational difficulties associated with direct investment in Bitcoin.

If the SEC were to approve a Bitcoin ETF, it would be a significant step within the entire cryptocurrency space. Although the SEC has not yet approved any Bitcoin ETF, despite numerous requests, BlackRock is firmly committed to pursuing this path. Success in this direction could mark a watershed moment for crypto investing across a variety of funds.

Consultation process for the approved MiCA is launched

The European Union is about to launch a consultation process for the recently adopted Markets in Cryptoassets Act, or MiCA, framework. This initiative may have a significant impact on the regulation and control of cryptoassets in the European market.

According to an announcement published on the European Securities and Markets Authority's (ESMA) website, the consultation process will consist of three parts. It will cover authorisation, governance, conflicts of interest and MiCA complaint handling procedures. These measures will be subject to approval by the European Commission, the European Parliament and the European Council.

MiCA is expected to establish a consistent regulatory framework for crypto between EU Member States. At the same time, it is expected that the MiCA could come into full effect in approximately 18 months, with full application of all rules from December 2024. This move may provide the necessary regulatory clarity for digital assets within the European Union.

Hong Kong government appeals to banking giants to accept crypto clients

The Hong Kong Monetary Authority (HKMA), acting as the region's central bank and regulator, is making a strong appeal to major banks, including HSBC, Standard Chartered and Bank of China, to more actively consider accepting cryptocurrencies as their clients.

The HKMA met with these banks in May and alerted them to the need for greater engagement with cryptocurrencies. This follows a call issued by the HKMA in late April. In that document, the central bank stressed that banking institutions should pay attention to new market developments and take a more proactive approach to new sectors such as the cryptocurrency market.

This effort by the HKMA to support cryptocurrencies is part of an effort to create a more conducive environment for digital assets in Hong Kong. It also contrasts with the turbulent regulatory environment for crypto exchanges in the United States, where the U.S. Securities and Exchange Commission is complaining about Binance for violating domestic securities laws.

A new regulatory policy in Hong Kong, which came into effect on June 1, allows locally licensed crypto firms to begin operations. With a valid license, these firms can provide services to retail investors, who thus gain access to trading cryptocurrencies, including Bitcoin and Ethereum. The move should help create a stronger backdrop for digital assets in the region.