TOP-Beiträge

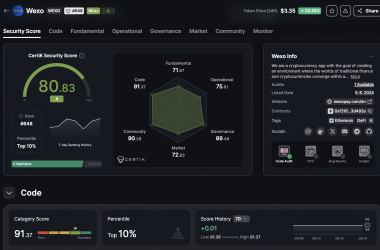

Prestigious auditor ranked WEXO among TOP10% of projects

The listing on a centralized exchange, together with the excellent audit result and the 8th place among payment pro...

Mehr lesen

Wexo Points: Find places where you can pay with Bitcoin (App Up...

Search nearby businesses that accept Bitcoin payments

Mehr lesen

Wexo Meetup Košice on 27 April (invitation)

Saturday full of news and innovations this time in the metropolis of the east!

Mehr lesenThe parent company of popular platform OnlyFans, Fenix International, has shown its vision and confidence in cryptocurrencies by investing nearly $20 million in Ether (ETH) between 2021 and 2022. According to a filing made to the UK's Companies House in August, Fenix International has invested approximately $19.9 million in ETH.

Despite the changes in the cryptocurrency market, the OnlyFans platform hasn't just experienced success in the digital currency space. Their revenue has grown significantly by 16.6% from $4.8 billion in 2021 to $5.6 billion in 2022. The number of content creators has increased by 47% and the number of subscribers has increased by 27%.

This successful trajectory was also made visible in innovative projects. In February 2022, the platform allowed verified creators to turn their profile pictures into Ethereum-based NFTs. In June of the same year, a pair of former OnlyFans CEOs launched a celebrity card trading platform called Zoop, which was built on the Ethereum platform Polygon. Thus, OnlyFans shows that it is ready to explore new possibilities in the digital space.

Stablecoins transform SMEs in developing countries

In a rapidly globalizing world, small and medium-sized enterprises (SMEs) in developing economies face significant barriers to accessing the global financial system. Despite their key role in economies - they account for up to 90% of all businesses and employ 50% of the global workforce - many are unable to expand effectively without access to global financial resources.

Thanks to blockchain technology and its innovation in the form of stablecoins, which are digital tokens tightly linked to fiat currencies, these businesses can overcome traditional barriers. Stablecoins, such as USD Coin (USDC) and Tether (USDT), enable SMEs to access the financial system, bypass forex restrictions, conduct fast and efficient transactions, and ensure financial inclusion with a high degree of transparency.

Platforms such as DLTPAY have been created to support integration with this new technology. This platform for Web3 payments and DeFi offers a unified solution to simplify the inclusion of SMEs into the blockchain world, enabling them to make stablecoin-based payments and adapting to their specific needs, opening the door for them to grow and succeed in the global marketplace. Likewise, the Wexo platform has plans to soon launch terminals for entrepreneurs to accept payments in cryptocurrencies.

Spanish central bank official talks about the digital euro era

The representative of the Bank of Spain, Margarita Delgado, recently spoke to students and experts in Pamplona about the introduction of the digital euro. She explored the future through the prism of the recently proposed EU legislative roadmap for the digital euro and went into detail on how private payment solutions will interact with the digital euro and its infrastructure.

According to Delgado, the digital euro can help the European Union overcome challenges such as barriers to cross-border payments, costs for businesses using private payment services, and a general lack of these services in Europe. The development of central bank digital currencies and stablecoins in other regions could exacerbate this problem without the introduction of the digital euro. She commented: "We believe there is enough room for digital euro and private payment solutions to coexist. In fact, we expect the digital euro to enable the emergence of new pan-European payment and financial services from the private sector, making it easier to compete with non-European solutions."

The digital euro will not be insured by ordinary deposit insurance until common supervision and a resolution mechanism under the European Deposit Guarantee Scheme is in place. Financial security needs to be considered before launching the digital euro, Delgado added. The European Central Bank (ECB) plans to introduce the digital euro in the euro area first and then expand its scope. Outside the euro area, it should provide new opportunities for private payment services. The ECB also has its own requirements for regulating these services. Delgado said the ECB is asking payment services to commit to making the digital euro available to the general public and to offer a physical digital euro payment card.